Here is a quick run-down on what you will find in this bulletin: Windows 11…

Update News for August 2024

Here is a quick run-down on what you will find in this bulletin:

-

-

More Reasons I Don’t Believe The Inflation Number

-

How Do YOU Personally Fight Inflation?

-

This Calculator Will Help Sell Larger Face Amounts

-

Staging Insurance Policies

-

Are Those Big Numbers Crazy?

-

Price Increases in September

-

Our Current Programming Plans for 2024

-

These topics will be dealt with in more detail throughout this bulletin.

says:

The plan, announced in April and approved by the Postal Regulatory Commission in late May, raises overall mailing services product prices by 7.8 percent.

and

On Sunday, stamp prices will have risen 46% over 2019 when they were 50 cents.

46% over 5 years is 9% per year (simple interest). It is actually about 8% when you factor in annual compounding.

I also said last month that I believe that the Federal government is keeping the inflation number artificially low until after the election. I expect next years inflation numbers to be much more accurate.

I also emphasized that the driver of U.S. inflation (ANY inflation in ANY country) is government deficit spending. Making that worse is the accumulated national debt and the interest that must be paid on that debt. Inevitably interest on that debt must go up with inflation, which leads to more deficit spending. It’s a dog chasing its tail and it’s NOT a pretty picture. This article will give you a better idea of what is happening.

All this to explain Compulife’s systematic small annual increase in prices.

I decided to repeat this story from last month after I had a subscriber ask me (just this past month) “WHY” we were increasing our prices. My one word answer was “INFLATION”. Obviously they didn’t read the July bulletin. Once again, we are charging more because the value of a dollar is systematically shrinking and I believe that the inflation problem is just getting going and that it is NOT going to go away.

First, embrace the reality of it. Inflation is here and it is going nowhere. Once again, read the “ticking time bomb” article above so you understand the fundamentals. As someone who lived through the Carter presidency, I have seen this before and could see this coming as our national debt has gotten out of hand.

Second, UNDERSTAND what it does to the value of money. Inflation has the opposite impact of earning interest on an investment.

You need to learn the rule of 72. The rule of 72 says that if you have 6% annual interest, you take 72, divide it by 6% and the result will tell you how many years (in this case 12) it takes for money to double with interest. Inflation is the exact opposite. If you have 6% annual inflation, it takes 12 years for money to be worth 50% of what it is worth today.

Using the same formula you can find out the interest rate it takes for money to double. For example, for money to double in value in 10 years, you have to earn 7.2% interest (72/10 = 7.2). Or, for money to be worth 50% of its current value in 10 years, it takes 7.2% inflation. Remember from the story above, that postal rates have increased about 50% in 5 years. That means if that keeps going, postal rates will double in about 9 years. Divide 9 into 72 and that’s 8% inflation.

How does this apply to selling life insurance? When you are recommending how much life insurance your prospects and clients need, the amount of insurance you recommend should be higher than it was in the past. Why? Because their cost of living and their wages are going up. The total face amount of insurance that they need to buy will also need to increase. The premiums will be higher, but let’s remember that over time you are paying those premiums with dollars that are getting smaller and smaller in value.

This is also a variation of it on our website: www.term4sale.com. At the bottom left corner of the home page you will find this box:

Click on the Life Insurance Needs Calculator. The explanation is all set out in the web pages that follow.

The Income From Capital Analysis that is in your PC software can do much more than just that. But the primary use is to demonstrate to a prospective life insurance buyer how the death benefit can be managed in order to provide an income for a period of time. THAT is the problem facing any beneficiary who loses a bread winner that they are dependent upon.

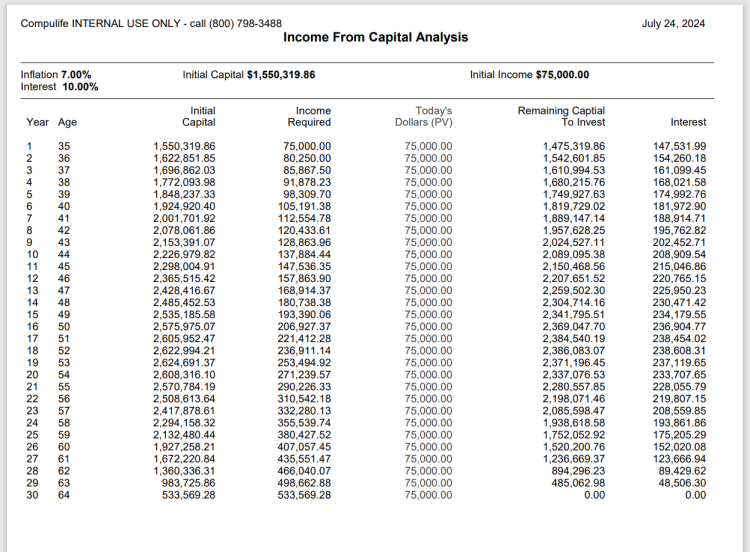

Here is a screen shot of an Income From Capital Analysis presentation for a 35 year old, for 30 years, who needs an income of $75,000 per year. In this example I assumed 7% inflation, and 10% interest.

You can click on the image for a larger version.

I realize that 7% inflation is higher than it currently is (officially) but those will be the numbers before long. Whether you agree with me or not, the inflation rate is NOT as important as the “spread”, which is the difference between inflation and the interest you can earn at that inflation rate.

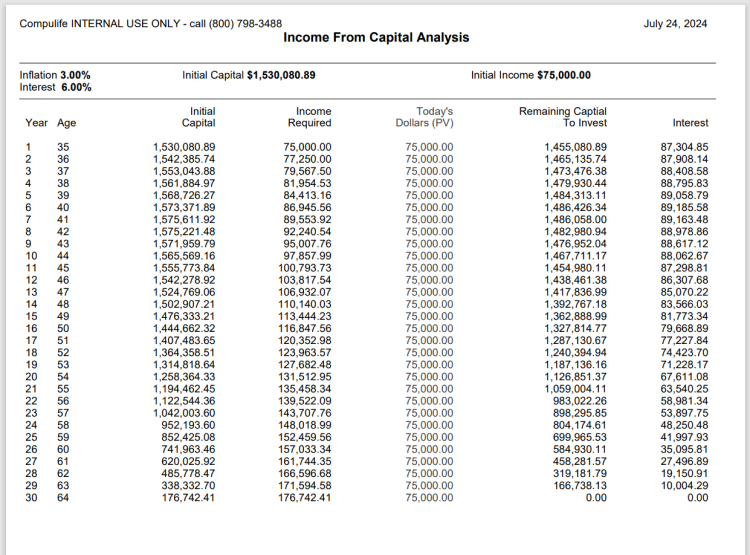

Here’s the same schedule, using 3% inflation and 6% interest.

Notice that the starting number for both presentations is virtually identical, 1,550,319 versus 1,530,080. Despite the difference in actual inflation and interest, the result is the same. Both schedules pay a $75,000 income for 30 years (in today’s dollars; Present Value). And in both schedules they end up with ZERO at the end of 30 years. It’s the numbers along the way that are different, and they are different by a LOT.

Take a look at year 19 in both spreadsheets. In the 7% inflation spreadsheet, the initial capital has to balloon up to 2,624,691. By contrast, with only 3% inflation, the capital has decreased to 1,314,818, roughly half the amount of money.

Why do we need so much more money in year 19 with 7% inflation? Take a look at the income required in year 30. With 7% inflation the last year’s income required is $533,569. That is the same value (Present Value) as $75,000 in today’s money. By contrast, if inflation is only 3%, then the income required in the 30th year is $176,742 (about 1/3 as much). Big difference, but the starting number (today’s need for insurance) is the same with both schedules. That is why I say it is all about the “spread” between inflation and interest.

In a perfect world with ZERO inflation, or only 1 or 2 percent inflation, that makes sense. The problem when inflation starts to kick in is that the value of the dollar shrinks. You end up needing more and more insurance because the total amount is shrinking in value with inflation.

Take a look at the Initial Capital column in the 7% spreadsheet above. Notice how the number grows from years 1 to 20. In reality, each year’s initial capital is the amount of insurance you would need at that point, to pay the income for the period remaining. It is ONLY in year 28, with only 2 more years to go, that your need for term insurance actually is less than the initial $1,550,319 that you started with.

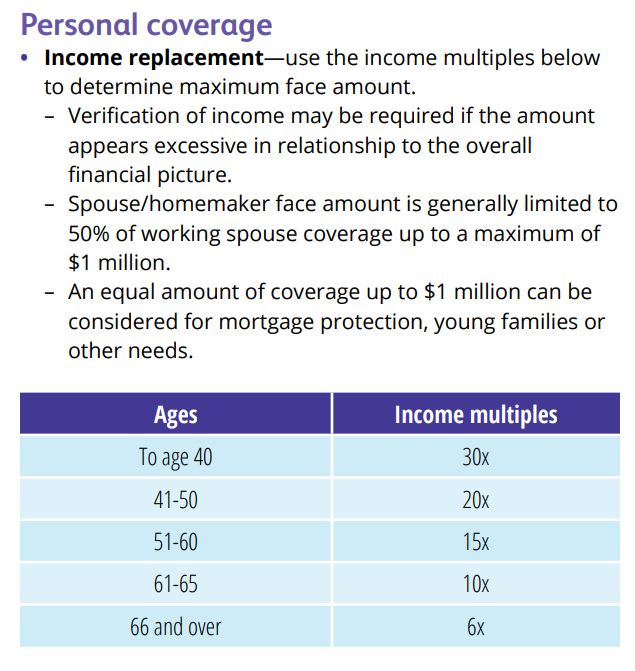

I recently made some changes to Protective Life’s health criteria in our system (they needed updating). As I read their guide I came across these insurance limits for income replacement needs.

In our example we found that it takes a 35 year old 20 times their $75,000 income in order to provide their income to their family for 30 years. According to Protective you are allowed to sell a person age 35 up to 30 times their income, which would be a face amount, in the examples above, of $2,250,000.

Go back and have a look at the Initial Capital values in the 7% inflation schedule, and watch the amount of insurance needed get larger as time goes on, peaking at 2,624,691.

If these number look crazy to you, perhaps you don’t understand inflation the way you need to. My advice, start understanding it because there is a LOT of it coming your way. And inflation isn’t just your problem, it is a problem facing your clients and they will want to do business with an agent who can help them solve the inflation problem.

We tried to keep the price increases around 3%, which I still think is lower than the actual inflation rate.

| Product | New Price | Old Price |

| Mobile Quoter | 110 | 104 |

| Website Quoter | 215 | 209 |

| Personal Use PC | 215 | 209 |

| Agency Use PC | 380 | 369 |

| API – 1,200/m | 470 | 454 |

| API – 6,000/m | 935 | 909 |

| API – 30,000/m | 1,460 | 1,419 |

| Internet Engine | 1,875 | 1,819 |

| Batch Analyzer | 2,320 | 2,250 |

| Historical Disk | 115 | 109 |

Having noted that we are keeping this year’s price increases to 3% for everything else, I fully expect next years inflation numbers to jump quite a bit higher. You should plan and expect that we will adjust prices accordingly.

Given that, we would encourage you to LOCK in the old prices by pre-paying. You can send an email to service@compulife.com and we will be happy to send you an invoice for a one year, two year or three year subscription (in addition to your current subscription) all at the old price. If you go two or three years, you can take a further 10% or 20% off the total cost respectively. And no, we do NOT accept renewals longer than 3 years; I’m not kidding about inflation.

NOTE: The 10 and 20 percent multi-year discounts can be applied to “local” zip codes that are tied to your subscription. However, the discounts are NOT available to additional zip codes which renew at the end of the calendar year. As additional zip codes can be bumped, and you could lose one or more additional zip codes, we keep all renewals limited to the current year.

When thinking about multi-year discounts, we want to point out that in October Compulife comes to our 42nd year in business. We think you can trust us to still be around 3 years from now. And if prices do go up next year, (as they are doing in September), then prepaying for up to 3 years gives you a great discount by locking down the old price in additional to taking multi-year discounts.

-

-

- Introduction of New PC Version: CQS.EXE

-

-

-

- Overhaul Of Current Product Data Files

-

-

- Introduction of Compulife Mobile* Plus (with Pick 12)

Anyone with questions about any of these upcoming projects can call Bob Barney to discuss:

(888) 798-3488

Please don’t email me essay questions, just call. If I’m not in, email me your phone number, I’ll call you.

These planned objectives will easily consume our programming time during the balance of this year and throughout 2024. The good news is that once the product data files have been converted, and we have introduced the new CQS.EXE, and upgraded our internet engine to use the new data files, Compulife will be turning it’s full attention to our web based, Compulife Mobile software. The long term goal is to have a web based product that does everything our PC based software does.